Diversifying Portfolios with Collectables

The 1fs Wealth event on collectables was a resounding success. Our esteemed panellists have been kind enough to share some of their most valuable insights below.

Art is often defined as a safe haven asset, meaning that it is a value preserving asset-class, especially in times of economic and financial crisi. Like gold, in fact, art is less susceptible to risks associated with financial market crashes than stocks and bonds and, due to its intrinsic value as a luxury item and its scarcity, art is able to rebound and even grow faster than traditional asset classes, as it isn't hugely influenced by trends in the financial market.

Moreover, the Art Market Report 2021 by Art Basel indicated active engagement in the art market despite the Covid-19 pandemic, with 66% of those surveyed reporting that the pandemic had increased their interest in collecting, including 32% who reported it had significantly done so. This is also demonstrated by the fact that, in 2020, the most challenging year in contemporary history, global sales of art and antiques reached an estimated $50.1 billion, down only 22% in 2019, showing a considerable increase in the value of many Blue-Chip artists.

— Francesca Casiraghi, London Trade Art

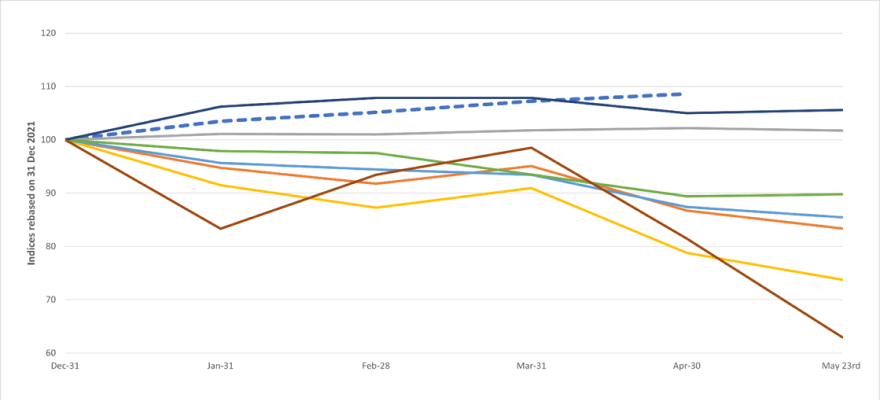

Investment grade collectibles such as fine wine are seeing increased interest given the uncertainty in financial markets and inflation hitting multi-decade highs. The fine wine markets benefit as a source of diversification with low equity correlation, less volatility than most mainstream financial instruments and being a good hedge against inflation are driving investors to allocate a higher proportion of their wealth to wine than ever before.

Fine wine has a unique supply and demand dynamic that makes it far less susceptible to outside market influences, while the lower liquidity of fine wine and the fact that there is no leverage in the market means that major sell-offs are extremely unlikely. Even putting the investment upside, with returns of 19.08% in 2021 and an 8.6% return YTD (Source: Liv-ex1000) aside, investors see collectibles such as fine wine as a great place to store cash in these turbulent times.

— Josh Palmer Ramus & Marcus Allen, Cult Wines